Turkish inflation falls more than expected to 44%

Canada Global (Web News) Turkey's inflation rate for December came in lower…

The Bank Of Canada Cut Its Interest Rate By 25 Basis Points Overnight

Canada Global(Web News) The Bank of Canada cut its interest rate by…

The Bank Of Canada Has Announced That Interest Rates Will Remain At 5 Percent

Canada Global(Web News) The Bank of Canada has once again announced to maintain…

Alberta Has The Most Interprovincial Migration, Statistics Canada

Canada Global(Web News)The provincial government has been selling the "Alberta Advantage" for…

Another Shock To The People Fed Up With Inflation, Electricity Is More Expensive

Canada Global(Web News) The National Electric Power Regulatory Authority (NEPRA) has increased…

Despite The Reduction In The Price Of Petrol, Inflation Could Not Be Reduced

Canada Global(Web News) Despite the significant reduction in the prices of petroleum…

This Week, 14 Items Became More Expensive And 17 Items Became Cheaper, Statistics Agency

Canada Global(Web News) Due to government initiatives, the effects of the dollar and…

The Bank Of Canada Is Unlikely To Raise Interest Rates

Canada Global(Web News) It is possible that the Bank of Canada will…

More Than Three Thousand Lawyers Who Have Not Paid The Dues Of Crores Are Disqualified

Canada Global(Web News)More than 3,000 lawyers were disqualified for non-payment of dues…

Bank of Canada set to hike interest rate again amid inflation pressures

Canada Global (Web News) The Bank of Canada is scheduled to release…

Second Russian oil shipment reaches Pakistan

Canada Global (Web News) As Pakistan now relies on cheaper supplies from…

IPP will provide relief to inflation-hit people, says Aleem Khan

Canada Global (Web News) Abdul Aleem Khan, the president of the Istehkam-e-Pakistan…

Global airlines more than double 2023 profit outlook, recover from pandemic

Canada Global (Web News) In response to high travel demand as the…

Canada’s annual inflation rate unexpectedly increased to 4.4%

Canada Global (Web News) As higher housing costs led to the first…

Govt announces 12-rupee cut in petrol prices

Canada Global (Web News) Ishaq Dar, the Finance Minister, declared on Monday…

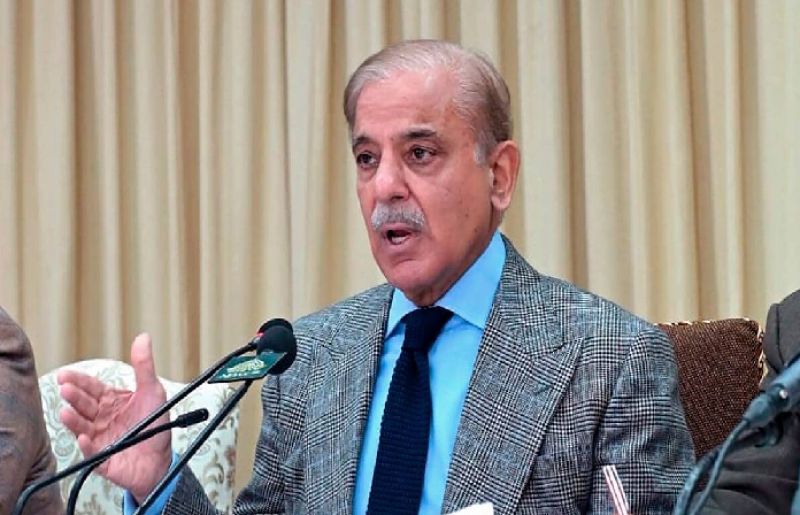

PM Shehbaz admits our political system is flawed

Canada Global (Web News) According to the prime minister, Shehbaz Sharif, systemic…

Petrol price likely to be hiked by Rs5 per litre

Canada Global (Web News) The federal government received a brief from the…

Government is bound due to IMF agreement, says PM Shehbaz

Canada Global (Web News) The International Monetary Fund (IMF), according to Prime…

Nepra raises K-electric power tariff by Rs6 per unit

Canada Global (Web News) The power rate for customers of Karachi Electric…